The network for e-invoices, e-payments, e-orders and e-financing.

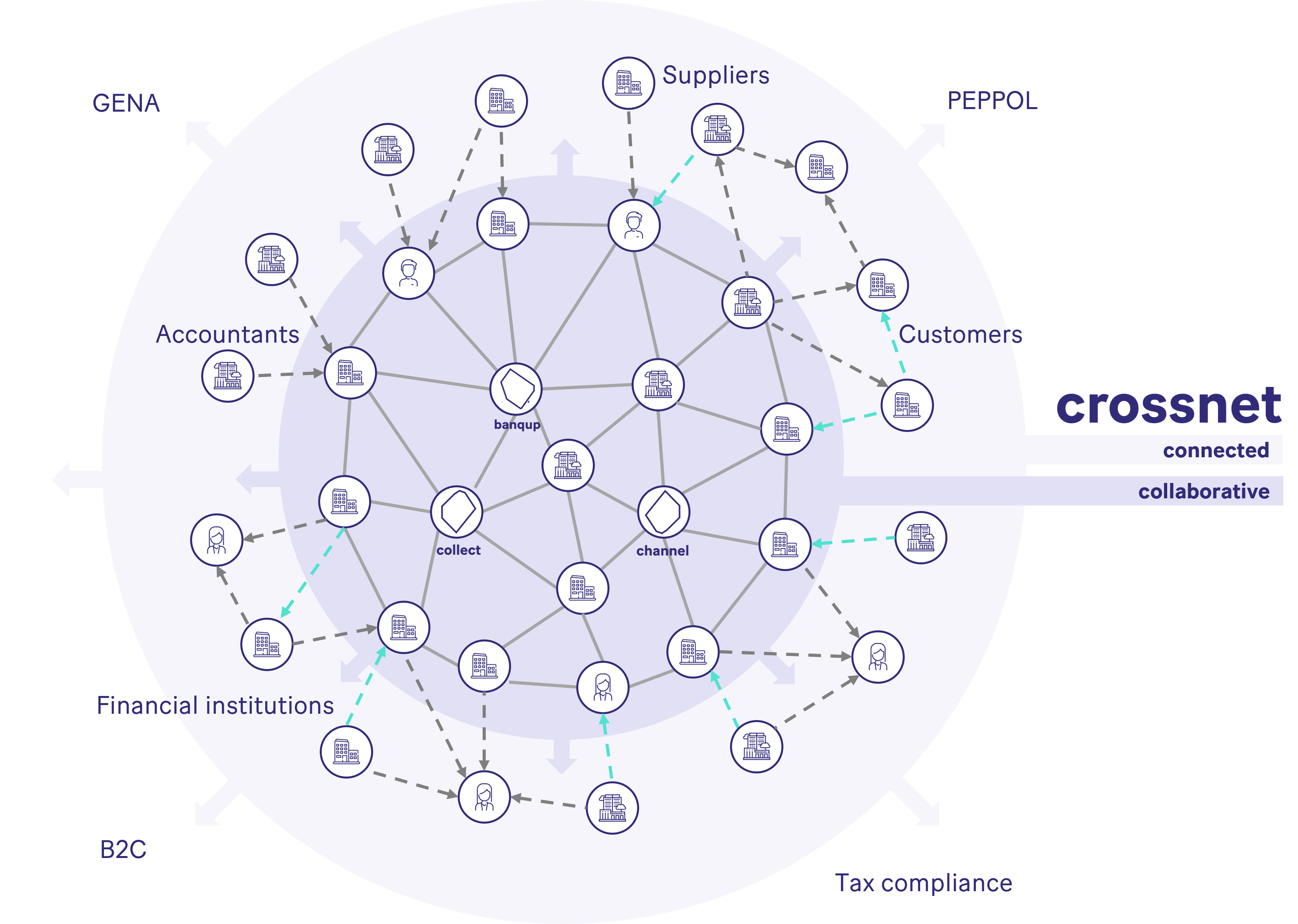

With “Crossnet”, Unifiedpost Group operates the leading network for e-invoices, e-payments, e-orders and e-financing. By connecting you with your stakeholders we automate your purchase and sales transactions and unlock liquidity for you. Over one million companies already exchange their documents through Crossnet. Products like Banqup, Collect and Channel serve small, midsize and large businesses alike.

The main benefit for your business is that just a single technical connection to our network enables you to communicate with all other participants. And by doing this, your IT infrastructure doesn’t need to change!

You can already meet your customers, suppliers and other stakeholders here! Those also using Unifiedpost Group solutions can even benefit from additional collaborative services like real-time reconciliation, instant payment and dispute management. Other partners can be connected by using a huge variety of interfaces, data formats and protocols. Even paper documents can be processed accordingly.

As new networks and tax compliance requirements constantly arise, we make sure you can benefit from and be compliant with those – worldwide. Whether it is the PEPPOL network, more than 100 service providers (GENA) or tax compliance platforms like SdI in Italy, TRA in Turkey or other networks in more than 60 other countries, we are already connected.

Practically every form of technology on this planet that states it reduces costs, is based on considerable initial investments and changes to IT infrastructure. This is not the case with e-solutions from Unifiedpost Group.

Even though your documents are now digital and are no longer required on paper, this does not mean that your IT infrastructure needs to change.

There is no need to even install additional software, as you can communicate with all your business partners via one single interface with Unifiedpost Group. It also doesn’t matter which accounting systems, if any, that you use – as we are compatible with them all.

Is it odd to think that sensitive data, above all else, should be organised via an external company? Don’t worry, as data protection and your data security are important to us!

We process data only in ISO-certified data centres with hosting in Europe and follow European data protection legislation.

Many financial institutions have audited Unifiedpost Group’s solutions and offer these solutions to their customers.

Unifiedpost Group has been tested and is tax compliant in over 60 countries. This is demonstrated by our ISAE 3402 certification, showing that data is handled in a secured compliant manner.

Large network (+1 million) that is steadily growing and is already widespread across the globe

One single technical connection to our network enables communication with all other participants and exchange all document types

Easy and quick options for e-payments and e-financing

Connection to external international data transmission standards