As part of our Navigating Global Tax Compliance webinar series we delved into the topic of tax compliance models.

The various tax compliance and e-invoicing models

Around the world, there are plenty of mandatory tax compliance and electronic invoicing (e-invoicing) variations. Each country has different jurisdictions which affect the rules, formats and taxpayer requirements. However, the current regulations can be grouped into five models which detail the role of the buyer, supplier, the tax authority and software providers.

Interoperability Model

The interoperability model can be seen as the most flexible model from a business perspective. The model provides businesses with the freedom to choose their software provider and to exchange various document types as part of the supply chain process.

The most common example of an interoperability model in practice is Peppol.

Peppol allows businesses from all over the world to voluntarily connect and exchange electronic documents. Peppol is a decentralised exchange of documents with no connection to tax authorities. Businesses wishing to exchange documents simply connect to one system using their software provider’s access point, without a government or tax authority applying their own variation of formats or regulations.

However, the use of Peppol is no longer just on a voluntary basis. Tax authorities are now mandating the use of Peppol to exchange business-to-government (B2G) electronic invoices. As there is an EU directive to encourage the use of B2G e-invoices, many tax authorities have chosen to take advantage and apply their own regulations. Such mandatory use can be seen in Europe as well as Australia and Singapore.

Real-time Reporting Model

The real-time reporting model is the first model that connects with the tax authority.

Tax authorities in Spain and Hungary first introduced this model to have visibility of real-time invoice data. Within this model, the supplier’s software provider must send a subset of the invoice data to the tax authority once an invoice has been generated. The tax authority receives the information they need, but the process does not encourage businesses to evolve and reap the benefits of a full e-invoicing solution. Suppliers do not need to send an electronic invoice to their buyers. This can still be carried out in paper or PDF format.

Certain countries who have the real-time reporting model in place are starting to evolve how the model works to the business’ advantage.

In Hungary, there is an option for the invoice created for the tax authority to become the legally accepted electronic invoice. Businesses were already sending the invoice information to the tax authority, therefore why couldn’t the tax authority not carry out the transmission step? The tax authority now makes the invoice available to the buyer, creating a more efficient business process, while still providing the tax authority the real-time invoice information they need.

Continuous Transaction Control (CTC) Model

The CTC model is the original blueprint for the mandatory clearance models around the globe. Many countries have taken the blueprint and made it their own. Countries such as Chile, Mexico, Brazil are some of the earliest adopters.

The CTC model requires the transmission and clearance (validation) of an invoice by the tax authorities before or after any goods or services can be delivered. This works in the following way:

- The supplier generates a valid fiscal invoice in a structured format. The structure and format is determined by each tax authority.

- The supplier sends the invoice to the tax authority via a software provider.

- The tax authority must “clear” the invoice - validates it and approves it.

- The supplier sends the invoice to the buyer and delivers the goods and/or services.

- The buyer must tell the tax authority that they have received the invoice, the goods/service and the commercial terms.

Within this model there is a designated tax authority system. The tax authority can choose whether or not to centralise or decentralise the clearing of the invoices. In countries such as Mexico, with a decentralised clearance system, there are accredited service providers, which perform the validation and approval on behalf of the tax authority. However, in decentralised and centralised countries, businesses can still choose how to send their invoices to their buyers. This exchange does not necessarily have to be carried out in a digital way.

The strength of the CTC model therefore forces digitalisation in the economy, but not all the way. Businesses have to be able to use software to create and send electronic invoices to the tax authority, but they can still choose non-digital ways to exchange invoices between other businesses.

A further weakness in the CTC model is the interference in the supply chain process in some countries. For example in Brazil, goods and services cannot be delivered until the invoice is first “cleared” by the tax authority.

Centralised exchange

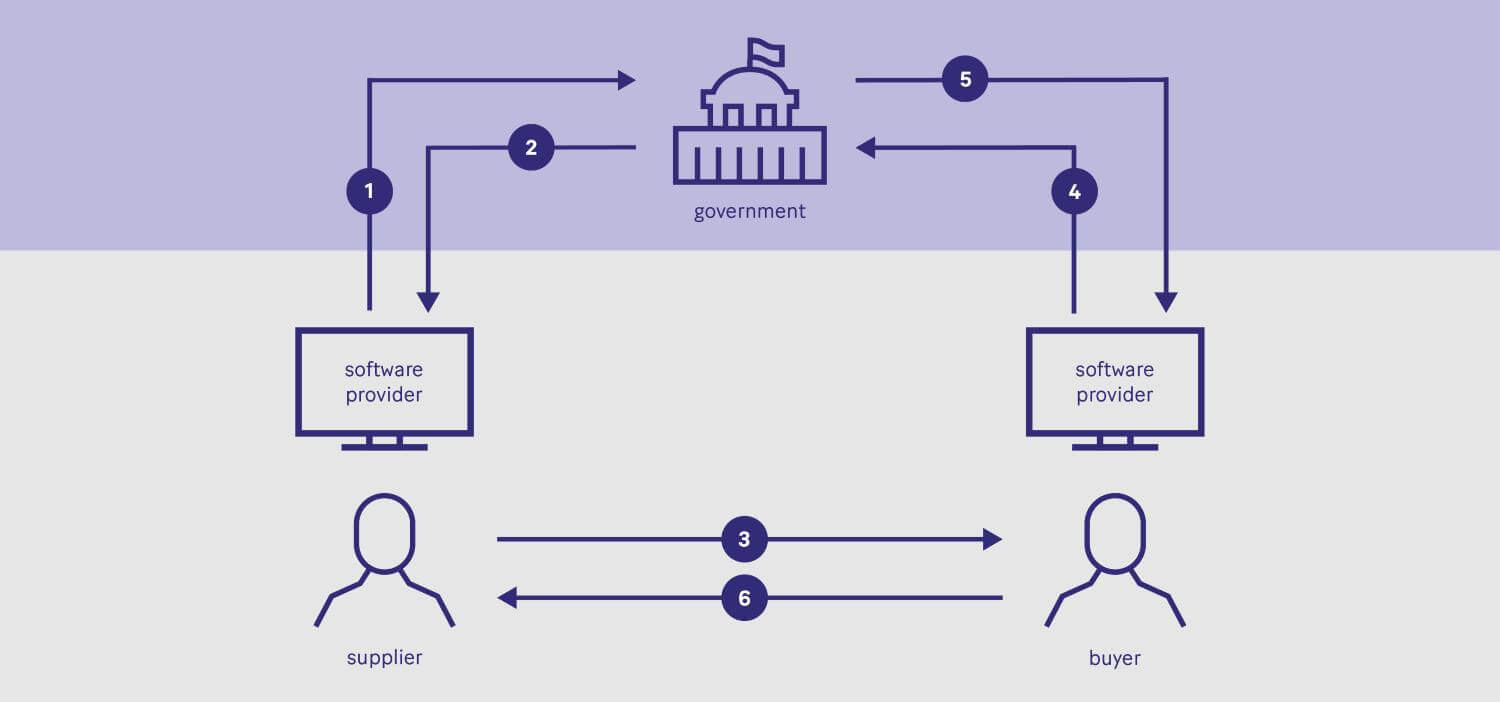

The centralised model is an iteration of the CTC model. Turkey was the first European country to introduce the model.

Turkey evolved the CTC model and removed a step for the supplier. Instead of the supplier sending the e-invoice to both the tax authority and the buyer, why not the tax authority carry out the extra step? The tax authority receives the e-invoice, “clears” it and then sends it to the buyer, all using one central tax authority platform.

There exists the risk that the mandatory data format is set to serve the needs of the tax administration, rather than considering and seeking supply chain efficiencies. The centralised exchange is in most cases limited to invoices and it does not cover the full range of business documents, which interfere with the full automation of procure-to-pay and order-to-cash processes.

Decentralised CTC and exchange

The decentralised CTC and exchange model is a combination of the interoperability model and the CTC model.

The validation and exchange of electronic invoices is undertaken by certified software providers, who must meet the minimum technical requirements specified in each country. The invoice’s data is instantly reported to the tax authority while at the same time exchanged between supplier and buyer (uninterrupted supply chain).

The decentralised CTC and exchange model has been proposed by a collection of suppliers, stakeholders and representatives. The model enables digitalisation for all parties involved - the supplier, software provider, tax authority and the buyer. The model allows tax authorities to cooperate with the market and allows businesses to reap the benefits of a fully digital process.

Discover more about the DCTCE model's origins via our interview with EESPA Co-Chair Marcus Laube.

Tax compliance models in practice: Stay up to date

Tax compliance models and regulations evolve continuously around the globe. At Unifiedpost Group, we want to ensure that you’re aware of changing global regulations and trends. To raise your awareness and to stay up to date, sign up to our free tax compliance email newsletter. Receive monthly regulation updates and increase your e-invoicing knowledge with our Unifiedpost Group experts.